New York State Tax Brackets 2025 Married Jointly - 2025 Tax Brackets Nyc Latest News Update, The new york married filing jointly filing status tax brackets are shown in the table below. Tax rate taxable income (single) taxable income (married filing jointly) 10%: Tax brackets married filing jointly — Teletype, Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. For exact numbers, see data table.

2025 Tax Brackets Nyc Latest News Update, The new york married filing jointly filing status tax brackets are shown in the table below. Tax rate taxable income (single) taxable income (married filing jointly) 10%:

2025 Tax Brackets Announced What’s Different?, Said it planned to lower that threshold to $5,000 in aggregate payments annually, with no transaction minimums, before it eventually lowers it to its permanent. Information about tax rates and tax tables for new york state, new york city, yonkers and the metropolitan commuter transportation mobility tax by year are provided below.

Page last reviewed or updated: Your tax is $400 + 6.0% of the amount over $10,000 in.

Irs 2025 Standard Deductions And Tax Brackets Danit Elenore, Income from $ 0.01 : Said it planned to lower that threshold to $5,000 in aggregate payments annually, with no transaction minimums, before it eventually lowers it to its permanent.

Tax rate taxable income (single) taxable income (married filing jointly) 10%:

New York State Taxes What You Need To Know Russell Investments, Single or married filing separately income of $8,500 or less: Married filing jointly and qualified surviving spouse

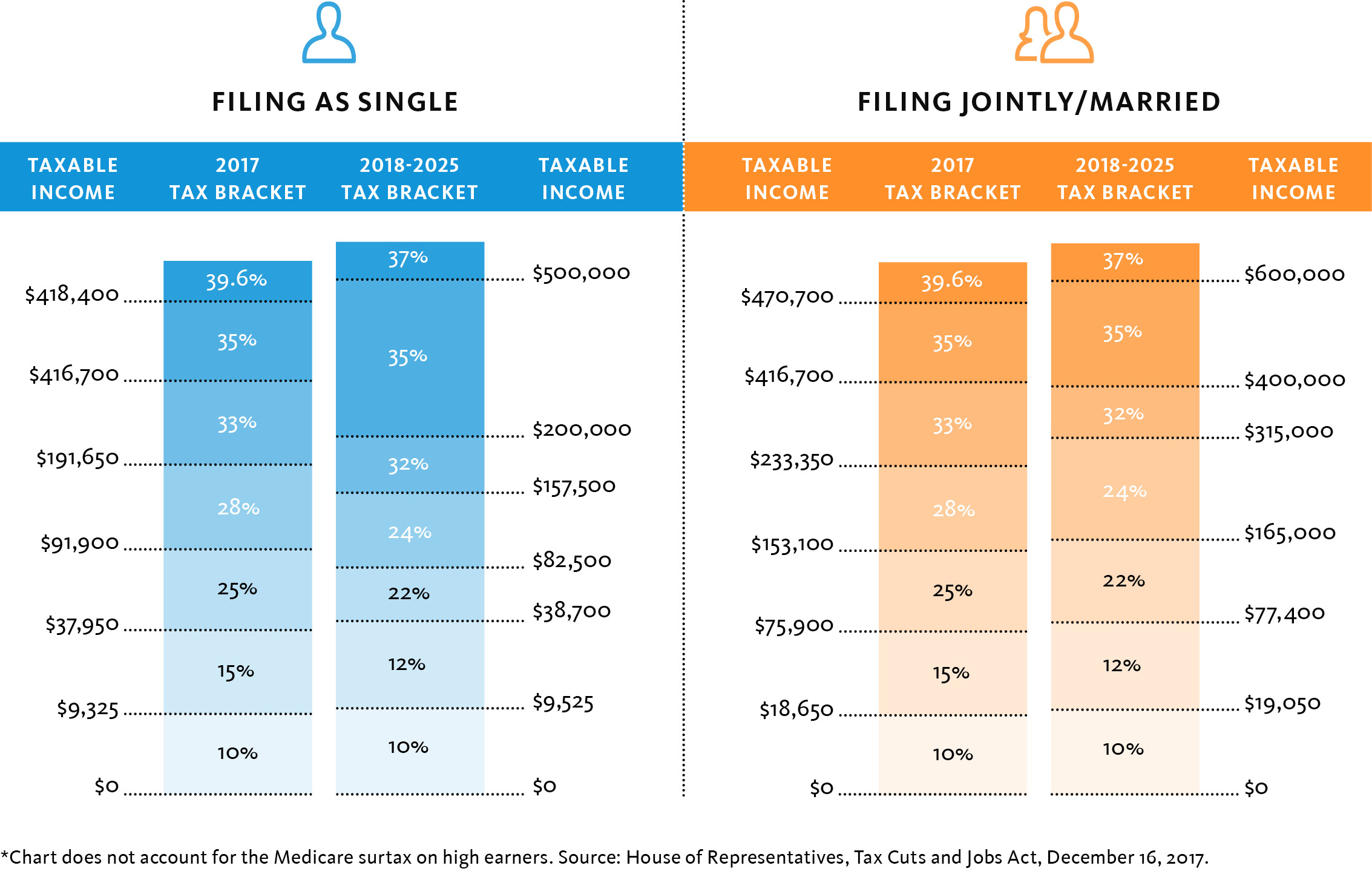

brackets reveal your tax rate as deadline to file 2025 taxes is, For exact numbers, see data table. New york residents state income tax tables for married (separate) filers in 2023 personal income tax rates and thresholds;

About Tax Brackets Married Filing Jointly Es Article, Each marginal rate only applies to earnings within the applicable marginal. Income from $ 0.01 :

New York State Tax Brackets 2025 Married Jointly. Page last reviewed or updated: The new york married filing jointly filing status tax brackets are shown in the table below.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Income tax rates in new york state vary from 4% to 10.9%, contingent on factors like taxable income, adjusted gross income, and filing status. The federal income tax has seven tax rates in 2025:

Irs Tax Brackets 2025 Married Jointly Latest News Update, New york residents state income tax tables for married (separate) filers in 2023 personal income tax rates and thresholds; For exact numbers, see data table.